For security reasons, Cigna.com no longer supports your browser version. Please update your browser, or use an alternative browser such as Google Chrome, Microsoft Edge, or Mozilla Firefox for the best Cigna.com experience.

Valuable Insights: Recent CMS Updates Affecting ACOs

Erin DeLoreto – Assistant Vice President, Value-based Programs

Recently, the Centers for Medicare & Medicaid Services announced several updates that affect accountable care organizations (ACOs). Watch this webcast, or read a summary below, to get an overview of the following updates:

- Performance Year 2019 Quality Payment Program Deadline Extension and Impacts

- Shared Savings Program “Extreme and Uncontrollable Circumstances” Policy

- Key Waivers for ACO Participants

Quality Payment Program (“QPP”) Extends PY2019 Reporting Deadline

The Centers for Medicare and Medicaid Services (“CMS”) Quality Payment Program (“QPP”) has extended the performance year (“PY”) 2019 reporting deadline from March 31st to April 30th. Eligible clinicians participating in the Merit Based Payment Incentive Program (“MIPS”) or the Shared Savings Program (“SSP”) now have additional time to meet the minimum reporting requirement for PY2019. This extension applies to MIPS Quality, Promoting Interoperability (“PI”), Clinical Practice Improvement Activities, and Cost categories; as well as Web Interface quality reporting for the SSP Accountable Care Organizations (“ACOs”).

Eligible clinicians that do not meet the new deadline will automatically be granted an “extreme and uncontrollable circumstance” exemption: resulting in a neutral payment adjustment for payment year 2021. Providers participating in SSP ACOs that are granted this exemption will be removed from the ACO’s MIPS APM scoring for Promoting Interoperability.

Since MIPS payment adjustments are largely budget neutral – meaning that negative payment adjustments offset positive payment adjustments – CMS’ broad-based exemption in response to COVID-19 may result in lower-than-projected adjustments for payment year 2021.

For more information about the QPP extension, please visit https://www.cms.gov/newsroom/press-releases/cms-announces-relief-clinicians-providers-hospitals-and-facilities-participating-quality-reporting.

Impact of “Extreme and Uncontrollable Circumstance” Policy for ACOs

In 2017, after a harrowing hurricane season for many parts of the country, CMS refined the “Extreme and Uncontrollable Circumstances” policy for ACOs participating in the SSP. This policy is intended to insulate ACOs from adverse quality and financial penalties due to disasters.

On quality, CMS determines an ACO to be considered impacted by an “extreme and uncontrollable circumstance” if 20% or more of the ACO’s attributed beneficiaries reside in an impacted area or if the ACO’s legal entity address is located in an impacted area. If an ACO meets either of these criteria, CMS will set the ACO’s quality performance score to the mean quality performance score for all ACOs in that performance year. In the event that the ACO completely and accurately reported quality data, CMS will set the ACO’s quality score as the higher of the ACO's quality performance score or the mean quality performance score for all ACOs (42 CFR 425.502(f)).

On finance, CMS mitigates shared losses incurred in a performance year in which the ACO was impacted by an “extreme and uncontrollable circumstance” by reducing the ACO’s repayment amount. The amount by which shared losses are reduced is calculated as follows: [ACO’s shared losses] x [% of months impacted by “extreme and uncontrollable circumstance” during performance year] x [% of ACO’s beneficiaries who reside in an area affected by the “extreme and uncontrollable circumstance”] (42 CFR 425.610(i)).

It is important to note that CMS has sole discretion to determine the time period during which an extreme and uncontrollable circumstance occurred, the percentage of the ACO's assigned beneficiaries residing in the affected areas, and the location of the ACO legal entity. Per the interim final rule issued by CMS on March 30th, 100% of counties in the country are impacted by the COVID-19 public health emergency; the timing of this impact commenced in March 2020 and will conclude at the end of the public health emergency.

Centers for Medicare and Medicaid Services (“CMS”) Waiver Authority during Public Health Emergency

The declaration of disaster or emergency under the Stafford Act or National Emergencies Act by the President and a subsequent statement of public health emergency under Section 319 of the Public Health Service Act by the Secretary of Health and Human Services (“HHS”) authorizes the Secretary to issue “waivers” or modifications to federal program guidelines.

In the wake of the COVID-19 pandemic, a cascade of such waivers have been issued by the Trump Administration to help ensure that sufficient health care items and services are available to meet the needs of persons enrolled in federal health care programs – namely, Medicare, Medicaid, and CHIP. It is important to note that these waivers apply to the federally governed aspects of those program, although, following a federal waiver, state agencies will often waive regulations under their authority.

1135 waivers – named for the pertinent section of the Social Security Act – authorize providers and facilities to be reimbursed for services provided in good faith during a public health emergency. Examples of 1135 waivers include temporary suspension of prior authorization requirements, extending exiting authorizations through the end of the public health emergency, and relax provider enrollment requirements. An up-to-date list of states with 1135 Medicaid waivers as a result of COVID-19 can be found at https://www.medicaid.gov/state-resource-center/disaster-response-toolkit/federal-disaster-resources/index.html.

In addition to the 1135 waiver, the Secretary will frequently authorize an 1812(f) waiver to provide for skilled nursing facility (“SNF”) coverage in the absence of a qualifying hospital stay under structure circumstances.

If you are unsure if you are covered by a waiver issued in response to the COVID-19 public health emergency, we encourage you to contact your local Medicare Administrative Coordinator (“MAC”). A list of MACs by region can be found at https://www.cms.gov/Medicare/Medicare-Contracting/Medicare-Administrative-Contractors/Who-are-the-MACs.

If your MAC determines that you are not covered under the provision of the 1135 waiver in your state, you can request a waiver through your local CMS regional office. Instructions for requesting coverage under an 1135 waiver can be found at https://www.cms.gov/Medicare/Provider-Enrollment-and-Certification/SurveyCertEmergPrep/Downloads/Requesting-an-1135-Waiver-101.pdf.

CMS Expands Use of Telehealth

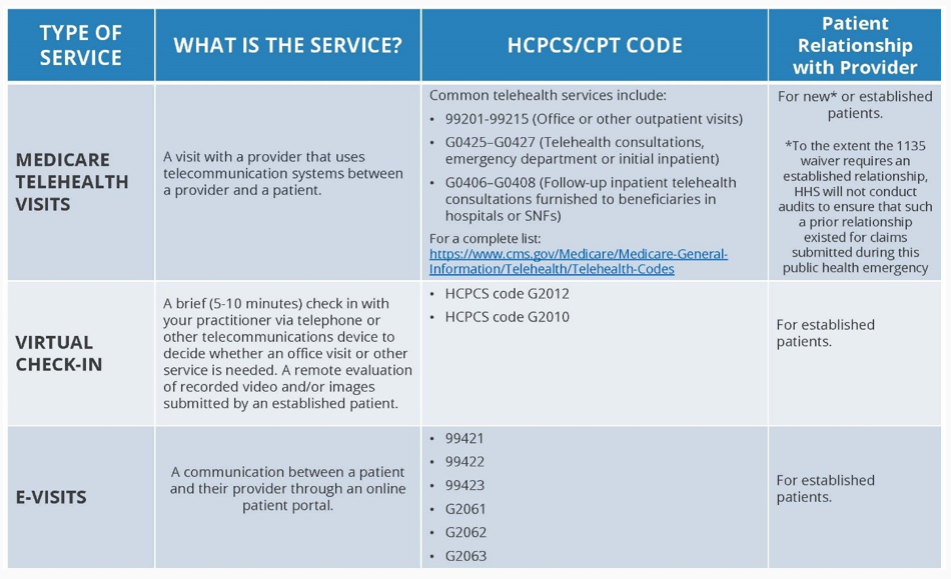

In an effort to minimize the community spread of COVID-19, the Trump Administration has expanded access to telehealth for Medicare beneficiaries. Typically reserved for use in rural areas only, the waiver directs Medicare to reimburse providers for office, hospital, and other visits furnished via telehealth anywhere in the United States.

Providers and patients with access to more robust telehealth platforms can bill a fuller list of services which can be found at https://www.cms.gov/Medicare/Medicare-General-Information/Telehealth/Telehealth-Codes. Additional E&M codes interimly approved by CMS for use during the public health emergency can be accessed at https://www.cms.gov/files/document/covid-19-physicians-and-practitioners.pdf.

Per the interim final rule issued by CMS on March 30th, CMS established an exemption to the definition of telecommunication system as follows, “Interactive telecommunications system means multimedia communications equipment that includes, at a minimum, audio and video equipment permitting two-way, real-time interactive communication between the patient and distant site physician or practitioner” (410.78(a)(3)(i)). CMS further clarified that, for the duration of the COVID-19 public health emergency, the Department of Health and Human Services will be exercising enforcement discretion and waiving penalties for HIPAA violations against health care providers that serve patients in good faith through everyday communications technologies, such as FaceTime or Skype.

The CMS Office of Inspector General (“OIG”) has also issued guidance in response to the COVID-19 public health emergency to notify physicians and other practitioners that they will not be subject to administrative sanctions for reducing or waiving any cost-sharing obligations Federal health care program beneficiaries may owe for telehealth services furnished consistent with the applicable coverage and payment rules. The specific terms of the OIG’s policy statement can be found at https://oig.hhs.gov/fraud/docs/alertsandbulletins/2020/policy-telehealth-2020.pdf.

As many provider offices and facilities have seen their routine census drop during the COVID-19 outbreak, the use of expanded telehealth services can help stabilize reimbursements for wellness activities, including Annual Wellness Visits, as well as ensure continuity of care for patients during the COVID-19 pandemic. For more information about CMS’ telehealth expansion, visit https://www.cms.gov/newsroom/fact-sheets/medicare-telemedicine-health-care-provider-fact-sheet.